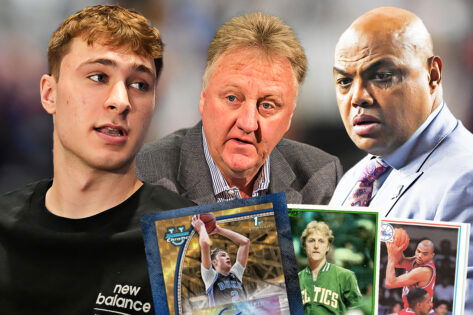

What’s in a name? Turns out plenty. Plenty of money. Cooper Flagg, the Duke star and a probable Mavericks star, already raked in big money as a college star. Now his name and image on a piece of cardboard are fetching eye-watering money. The 2024 Topps Chrome McDonald All-American trading card was sold for $85,400 last month at Goldin Auctions.

Cllct reports that it’s higher than nine NBA All-Stars of 2025 and 39 of the 75 players of the NBA’s 75-year-anniversary team. Jaylen Brown, Karl-Anthony Towns, Charles Barkley, Larry Bird, and Isiah Thomas–all are behind Flagg now.

That prompted some mighty and exaggerated debate. Without taking anything away from Flagg’s fame, it’s a bit premature to compare him to the legends based on trading cards. For good reasons, too.

Social media and NIL are the Game-Changers

Trading cards have surely come a long way from their first heyday in the 1870s, when color lithography and multicolor printing sparked a new hype around these shiny, polished trinkets.

Sports collectibles now have a $24.463M market in North America.

And college kids like Flagg are a key driver, thanks to their rising popularity on social media–Flagg has 1.1M followers on Instagram. Add to that the Name, Image, and Likeness deals.

On3 pegs Flagg’s NIL valuation at $4.8M, the second-highest among college athletes in the USA. Gatorade, New Balance, and Fanatics are some of the big brands betting on the Duke sensation.

Why wouldn’t collectors, then?

The case was significantly different during the time of Allen Iverson, Michael Jordan, Kobe Bryant, et al. Their fame was very much dependent on their on-court performance. This speculative buying–hedging your bet on a college star, hoping they live up to the hype–was non-existent.

Insanity: Cooper Flagg’s top card sale has already beaten the top cards of 39 of the NBA’s Top 75 players, including Larry Bird, Hakeem Olajuwon and Patrick Ewing.https://t.co/r0ME9IP43q

— Darren Rovell (@darrenrovell) May 14, 2025

In addition, the collectibles market was only a hobby of an esoteric group. Now? It’s a billion-dollar industry getting attention and, dare we say, respect, from established auction houses and investors on a global scale.

The Trading Card Industry itself has changed. Massively.

Gone are the days when collecting sports cards was just a pastime. Gone is the time when cards were aimed at only kids. Now, sports collectibles are an industry in themselves that continues to thrive despite the recent concerns from market experts. According to Market Decipher:

In 2024, the global sports trading card market was estimated to be valued at $33.6B.

In 2034, the projected valuation stands at $271.64 B.

That’s a growth rate of a whopping 22.1% CAGR.

In the last ten years, the collectibles industry has gone through exponential growth and dynamic shift. Primarily, three factors have been behind this boom:

Legitimization: Not too long ago, sports collectibles were auctioned mostly in niche online forums and marketplaces. Whereas, in 2024, Christie’s sold a Michael Jordan rookie card for $1.08M. In September 2024, Sotheby’s hosted a trading cards auction featuring high-end collectibles, including a 2005-06 LeBron James card that sold for $576,000. In April 2025, they curated an auction of legendary sports cards.

Investment: Sports collectibles have finally captured the attention of big-money investors. A LeBron James rookie card auctioning for $5M, or a T206 Honus Wagner fetching $7.25M, signals only one thing: investors have realized the potential for high returns from these rare cards, and they are betting big money on it. It’s quite telling that marketplaces like Collectable and Rally are letting potential investors buy a stake in the card instead of its entirety. So, collectibles are a new asset class in themselves.

Endorsements: Now, celebrities, influencers, and even athletes are active participants in growing the collectibles industry. They post about their own collections, injecting more enthusiasm among fans. Then you have players like Kevin Durant, Tom Brady, and the like who have also formed a strategic alliance with the marketplace platforms like Thirty Five Ventures and Fanatics, respectively.

Obviously, legends like Michael Jordan, Charles Barkley, and Larry Bird played before this ecosystem existed. More importantly, a host of legendary players, icons who shaped and reshaped the game, were already in their twilight before sports cards became an asset class.

While nostalgia has unlocked massive money in some cases, on a larger scale, Gen-Z will value the stars of the modern era more than the yesteryear’s superheroes. So, it’s not so much career greatness as it is the market dynamics, speculative valuation, and timing that are driving up the prices of trading cards.

The real valuation will be measured against legacy.

P.S.: It’s worth noting that Taylor Swift has 14 Grammys compared to the Beatles’ 8.

The post The Cooper Flagg Effect: NBA Legends Outsold as $33B Industry Embraces a New Era appeared first on EssentiallySports.