The walls began to close in when members of a key congressional committee sent letters to the leaders of the country’s biggest sports leagues. The message looked polite on paper but landed with a sting: it demanded an explanation of why watching a game has become so complicated—and so expensive. This wasn’t about just one sport; it was about a broadcasting ecosystem that had long enjoyed special legal protections. Those protections, written into the Sports Broadcasting Act of 1961, allow leagues to pool their TV rights and sell them together—an arrangement that would be an antitrust violation almost anywhere else.

That “why now?” question is easy to answer. Fans were already juggling multiple subscriptions, from cable to streaming, just to catch an entire season. Exclusive rights deals had turned following one team into a costly, fragmented experience. Lawmakers like Rep. Jim Jordan and Rep. Scott Fitzgerald decided it was time to dig in, with Jordan noting, “Everything’s on the table… that includes hearings, maybe legislation. We’re just at the first step, which is, what exactly is going on out there? How much does it really cost the average fan?” Those words weren’t just filler—they hinted at the possibility of reshaping the entire way sports are sold and watched in America.

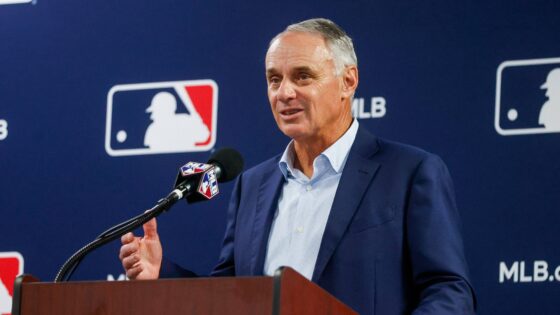

That’s where the “who” and “how” entered the picture. MLB promised to respond to the inquiry, but the timing couldn’t have been more awkward. Behind closed doors, commissioner Rob Manfred was also working to patch things up with ESPN after their $550 million-per-year broadcast deal unraveled. The split had been public, messy, and a little too personal for comfort. ESPN missed the steady flow of baseball content; MLB missed the network’s reach into living rooms nationwide. A truce wasn’t just about smoothing egos—it was a strategic move to bundle more rights into one attractive package for future bidders.

NEW YORK, NY – NOVEMBER 22: Major League Baseball Executive Vice President Rob Manfred speaks at a news conference at MLB headquarters on November 22, 2011 in New York City. Commissioner Bud Selig announced a new five-year labor agreement between Major League Baseball and the Major League Baseball Players Association. (Photo by Patrick McDermott/Getty Images)

And timing is everything. MLB’s national TV deals expire after the 2028 season, and Manfred has made it clear that he wants an overhaul before then. His vision is to combine national and local rights into a single offering, giving the league more control and consistency—and potentially more money. But that plan sits right in the middle of Congress’s new debate: how do you maximize revenue while keeping the game accessible to the very fans who keep it alive? With powerful competitors like Amazon, NBC, Apple, and Netflix circling, the next play will have to be MLB’s smartest yet.

But while Congress questions the fairness of sports broadcasting rules and MLB courts ESPN for a post-2028 overhaul, another battle is brewing inside the league—one that pits big-market powerhouses against the commissioner’s grand vision for a unified, blackout-free future.

Dodgers and Yankees’ Big-Market gains could prove roadblock in MLB’s exit

On paper, the fix sounds simple: end blackout restrictions and make every game available to every fan, anywhere. In reality, MLB’s plan to move toward a national, streamlined broadcast model runs straight into the financial wall of two of its richest franchises—the Dodgers and Yankees. The two teams sit atop colossal local TV deals that generate enormous revenue and grant them full control over how their games are marketed and distributed. For Manfred, modernizing the league’s media model means centralizing rights and eliminating blackouts. For these franchises, it means giving up a golden goose.

Manfred has made no secret of his frustration with the current setup, telling Pat McAfee, “We need to streamline our offering and get out of the blackout business.” He pointed. to the Padres takeover as proof that the demand exists—when MLB took over their local broadcasts, in-market MLB.TV sales jumped by 20,000 subscriptions in just two weeks. The potential is there, but the league’s fractured media landscape makes change anything but straightforward.

The sticking point is leverage. The Dodgers have a SportsNet LA deal locked in through 2038, while the Yankees own a majority stake in the YES Network. Surrendering those rights wouldn’t just be a financial sacrifice; it would be a major power shift within the sport. As sportscaster Lee Hackshaw Hamilton bluntly put it, “Teams like the Yankees, Mets, Red Sox, and Dodgers… are not giving those rights back to baseball.” And with the sting of losing ESPN’s $550 million-per-year deal still fresh—and the broader regret of a missed $1.5 billion revenue opportunity—Manfred’s push for a blackout-free MLB faces stiff headwinds.

Without buy-in from the league’s most powerful franchises, the dream of a national, fan-friendly broadcast model remains stuck in neutral. The result is a paradox: a commissioner armed with a vision the fans clearly want, but blocked by the very teams whose star power could make it succeed.

`

The post MLB Forced To Defend Broadcasting Policy As Rob Manfred Seeks ESPN Truce After $550M Fallout appeared first on EssentiallySports.